Vietnam's food trade industry is one of the most dynamic sectors in the country. Fueled by an expanding middle class, rising disposable incomes, and shifting consumer preferences, the increasing demand for high-quality food products is undeniable. From bustling markets in Ho Chi Minh City to modern supermarkets in other major cities, the opportunity for both […]

From my perspective after 15 years on the ground, Vietnam's banking sector is undergoing a period of remarkable expansion, making it a focal point for global financial institutions from Southeast Asia and beyond.

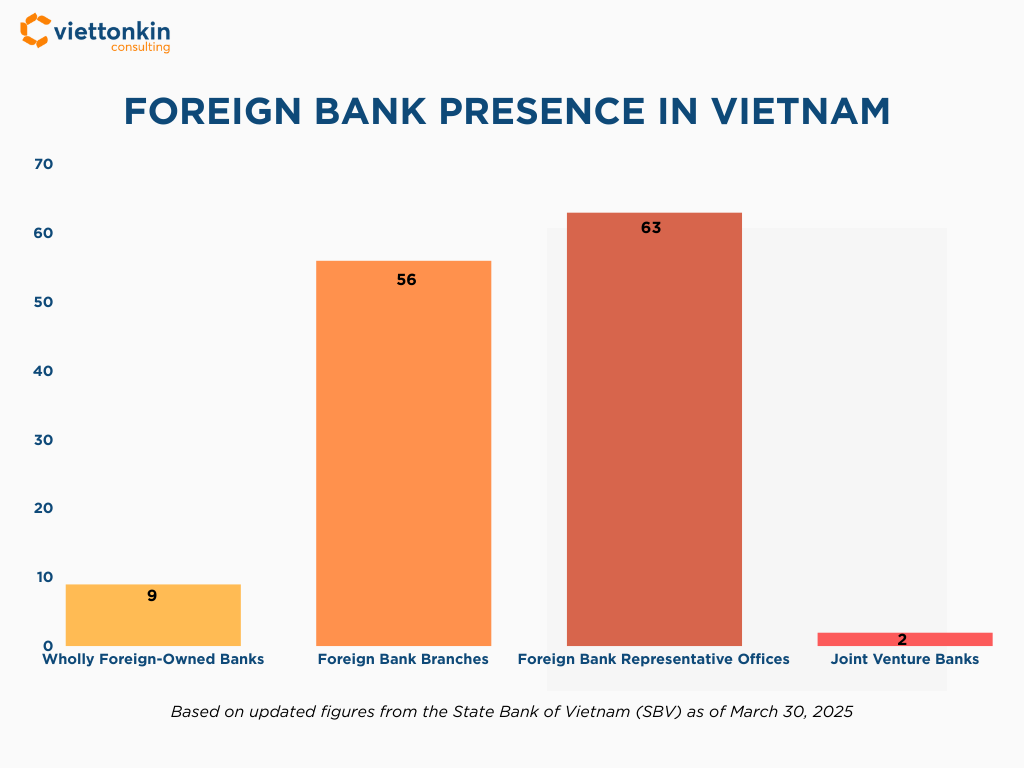

Reflecting the Vietnamese market's potential, the updated figures from the State Bank of Vietnam (March 30, 2025) show that the country's current structure hosts 9 wholly foreign-owned banks, 56 bank branches in Vietnam, 63 representative offices, and 2 joint ventures.

With this growing international presence in Vietnam, I'm seeing many foreign investors actively exploring the best strategies for establishing a foothold, with many starting their journey in key hubs like Ho Chi Minh City.

This article, drawing insights from our comprehensive Ebook, is where I share the practical guidance on the regulations, entry modes, and strategies I believe you will need to successfully establish a bank in Vietnam.

Key Takeaways:

- A Thriving Market: I believe Vietnam’s strong macroeconomic performance provides a stable and high-growth environment for foreign banks to operate and expand their banking services.

- Multiple Entry Options: Foreign investors can choose from several entry modes, including a representative office, bank branches in Vietnam, a wholly foreign owned bank, and a joint venture bank, each with distinct strategic implications that we'll discuss.

- Updated Legal Framework: Recent legislative changes have created new opportunities and requirements. From what I've seen, the Law on Credit Institutions 2024 and Decree 69/2025 have opened up opportunities by raising the total foreign ownership limits in specific cases.

In addition, the Law on Anti-Money Laundering 2022 imposes stricter requirements regarding customer due diligence and international cooperation. We've also seen regulations on IT system security and risk management also been tightened through legal documents such as Circular 50/2024 and Circular 62/2024. - Strategic Growth Beyond Entry: I always stress that success in Vietnam extends beyond the initial establishment license to include strategic equity investments, M&A, and capitalizing on the rapidly growing digital banking and fintech sectors.

- Overcoming Key Challenges: Establishing a presence in Vietnam requires overcoming significant hurdles such as high legal capital requirements, a lengthy approval process, and strong domestic competition.

I. Choosing Your Entry: Key Modes For Foreign Banks in Vietnam

From my experience managing client relationships at Viettonkin, the first and most critical decision an investor makes is choosing the right entry structure. This choice dictates your operational scope, capital requirements, and timeline.

1. Representative Office Or Branch Office

This is the most basic presence, limited to liaison and promotional activities, not revenue generating activities. A representative office is not considered a separate legal entity.

The primary advantage is the quick licensing time of just 30 to 60 days.

2. Foreign Bank Branches In Vietnam

A branch in Vietnam is permitted to conduct business operations but requires an unequivocal guarantee from its parent bank.

The licensing process is extensive, and I typically advise clients to plan for 200 to 250 days to secure the necessary banking license, and its activities are restricted by specific SBV rules. These legal entities must be fully backed by their head offices in foreign countries.

3. Wholly Foreign-Owned Bank In Vietnam

This structure offers the highest degree of operational autonomy and permits a full range of banking services.

It demands a significant minimum charter capital of at least VND 3,000 billion (approximately USD 130 million) and strict adherence to international practices. To get approval, applicants must submit audited financial statements and detailed business plans.

4. Joint Venture Bank And Business Cooperation Contract

A joint venture bank involves a partnership with one of the local Vietnamese banks, providing immediate market insight.

The foreign ownership ratio is typically 30%, though this can rise to 49% for restructuring banks. A business cooperation contract offers an alternative collaboration model without forming one of the new legal entities, allowing for the sharing of jointly controlled assets for specific projects.

II. Understanding The Regulatory Framework: Key Laws Governing Your Entry

Once you have a potential entry mode in mind, understanding the legal landscape is the next critical step.

The legal documentation can seem straightforward until it meets Vietnamese regulatory reality. The Law on Credit Institutions 2024 has introduced stricter licensing and governance standards, while new circulars from the State Bank of Vietnam (SBV) address everything from M&A rules (Circular 62/2024) to cybersecurity for online banking (Circular 50/2024).

A critical development is Decree 69/2025. According to VOV English (2025), this decree officially expands the foreign ownership ratio, raising the cap to 49% for banks undergoing banking restructuring.

This is a significant shift. S&P Global (2024) previously noted how the old 30% cap held back foreign investment.

This change reminds me of a client whose investment was nearly blocked by the old rules. From our experience, we engineered an alternative ownership structure using nominee arrangements that fully protected his investment activities while ensuring compliance.

III. Mastering The Approval Process: From Application To Operation

I always tell my clients that getting a banking license from the State Bank of Vietnam (SBV) is no small task. Foreign investors should expect a rigorous multi-stage process that requires careful preparation and patience.

- The journey begins with a detailed application, where banks must submit audited financial statements, a business plan, and a comprehensive risk management framework.

- Once the application is submitted, the SBV conducts an extensive review, focusing on the parent bank's financial health, compliance with international standards, and leadership background.

- If successful, the SBV issues the establishment license. However, to officially launch, banks must also obtain an Investment Registration Certificate (IRC), complete legal capital contributions, and implement all necessary systems.

Based on our experience, these are the approval timelines:

- Representative Office: 30–60 days.

- Bank Branch: 200–250 days.

- Wholly Foreign-Owned Bank: 200+ days, depending on complexity.

IV. Growing Your Presence: Strategic Insights For Long-Term Success

I always emphasize that securing a license is the beginning, not the end. Long-term success in Vietnam involves strategic growth.

1. Strategic Equity Investments In Banks In Vietnam

Strategic investors can acquire up to 30% of a local bank's charter capital, or up to 49% in restructuring cases. I've seen these equity investments are crucial for driving digital transformation and improving corporate governance, allowing a foreign partner to influence strategy.

2. Mergers And Acquisitions In The Banking Sector In Vietnam

M&A is a powerful tool for rapid market entry and expansion that I often recommend to clients. According to VIR’s Vietnam 2025 M&A Outlook: Trends, Deals, and Opportunities, in 2024 the sector saw 96 deals worth USD 3.2 billion, fueled by capital contributions from Japan, Korea, and Singapore.

The acquisition of GPBank by VPBank in 2025 is a notable example of this trend.

3. Digital Banking And Fintech Collaboration

With Decree 94/2025 establishing a regulatory sandbox, I see that Vietnam is actively encouraging innovation. This has led to powerful strategic partnership collaborations between banks and fintech platforms like MoMo and bePOS, creating new opportunities in digital financial services.

V. Anticipating The Hurdles: Key Challenges In The Vietnamese Market

While the opportunities are significant, so are the challenges. I always prepare investors for the reality of high legal capital requirements and lengthy, complex approval processes.

The domestic banking sector is highly competitive, especially in the digital arena, and compliance with international practices like Basel and IFRS adds costs.

I often advise clients that strategic planning is key. Take our long-term manufacturing client who trusted us with their expansion across five provinces.

The challenge was immense, but our systematic regulatory planning and proactive compliance monitoring led to a 300% growth in their investment value over four years. This same proactive approach is essential for navigating the banking sector.

VI. Your Roadmap To Success

From my experience, I can say that entering Vietnam’s banking sector is a promising but complex venture.

Understanding the entry modes, mastering the regulatory landscape, and planning for strategic growth are the keys to turning that promise into a successful reality.

Get the full step-by-step guidance on regulations, licensing, and strategies in our Ebook Foreign Bank Presence in Vietnam.

Download the complete guide here: Foreign Bank Presence In Vietnam Ebook.

Frequently Asked Questions

How long does it actually take to obtain both the Investment Registration Certificate (IRC) and the banking license from the State Bank of Vietnam (SBV)?

In practice, the timeline is longer than the statutory guidance. The IRC can usually be secured within 60–90 days, provided the dossier is complete. The banking license review by the SBV often extends the overall process to 12–18 months, depending on the complexity of the application, the responsiveness of the parent bank, and the quality of supporting documents.

Are foreign banks restricted from opening multiple branches in different provinces at the same time?

Yes. Under SBV regulations, a newly licensed foreign bank or branch must demonstrate stable operations and compliance in its initial location before applying for additional branches. The SBV typically requires at least 2–3 years of proven performance and regulatory compliance before granting approval for expansion into other provinces.

How does the SBV assess technology capacity and information security when licensing foreign banks?

The SBV places strong emphasis on digital resilience and cybersecurity. Applicants must submit detailed documentation on IT infrastructure, data protection systems, and cybersecurity protocols. Independent audits or certifications aligned with international standards (e.g., ISO/IEC 27001) are often requested. During the licensing process, the SBV evaluates whether the proposed systems can support secure online banking, anti-money laundering monitoring, and customer data protection in line with Vietnamese law and international best practices.