If you have a company in Singapore, you may be wondering how to be a tax resident, what benefits you are going to get, or you are asking yourself what is a certificate of residence itself. Moreover, you may occasionally need to produce a certificate of residence as well in order to pay tax and get benefits just like others. Thus, this article focuses on introducing the certificate of residence in Singapore and how to get one. Let’s keep reading!

READ MORE: How Viettonkin Consulting can help you process your Certificate of Residence

Overview of Certificate of Residence Singapore

A Certificate of Residence (COR) is a letter from the Singapore tax authority (IRS) stating that a company is resident in Singapore. The COR is also a letter certifying that you are a resident in Singapore for the purpose to claim the benefits under the Avoidance of Double Tax Agreements (DTAs). In other words, you need to have a COR to enjoy the benefits that the country will give you if you have the certificate.

However, the certificate of residence is not only valid for foreigners but also for Singaporean. It is more like Singapore tax resident and non-resident companies are generally taxed in the same manner, but the Singapore tax resident companies are able to enjoy these benefits:

- Tax benefits provided under Double Tax Agreements (DTA) between Singapore and other jurisdictions. These can take the form of lower rates of withholding tax or the blockage of source country taxation in certain circumstances.

- Tax exemption on foreign-sourced dividends, foreign branch profits and foreign-sourced service income under Section 13(8) of ITA.

- Foreign tax credits.

- Tax exemption scheme for new start-up companies.

These benefits are available to be claimed by a company in its domestic tax return filled with IRAS. On the contrary, the availability of tax benefits under a DTA often requires evidence of tax residency and provides the tax authority of the treaty jurisdiction in which the company is seeking a tax benefit from.

Here is the example to illustrate the situation. A Singapore company receives a dividend from Japan, and the domestic rate of withholding tax in Japan is slightly over 20% on dividends which had been paid to non-residents.

Moreover, under the Singapore / Japan DTA, this rate can reduce to as low as 5%, the Japanese company that pays the dividend will need some level of assurance for the lower rate application.

This assurance is provided in the form of a COR by the Singapore recipient, and providing a COR is also an administrative requirement that will be satisfied before a payer can conceal at a DTA rate.

What Factors That Are Impacting The Application of COR?

As a company owner, you should consider these factors before deciding to attain a COR for your company. The factors that you should take a note are:

- Being incorporated in Singapore does not automatically make a company to be a Singapore tax resident. The residency status may change from year to year, depending on the certain factors.

- Requires the proper documentations, such as minutes of the Board of Directors (BOD) meetings held in the year, noting the location, name of attendees and detailed description of the practical matters that had been discussed.

- The conduction of BOD meetings via conference call or video conferencing, the tax residency of a company based on the location of the majority directors.

- The location where an Annual General Meeting takes place is not relevant.

- The concept of control and management is exclusive. However, it is not possible for a company to claim tax residency in Singapore and another country where the same test of control and management applied. In an administrative way, the IRAS will need a Singapore company to confirm the COR application process.

- The IRAS defines additional requirements which apply to foreign-owned investment holding companies. Furthermore, the company must demonstrate a business reason for establishing in Singapore, also it needs to have an additional indication of economic substance.

It includes the existence of related companies carrying on business in the country, such as receiving administrative services from a group company in Singapore, or have at least one executive director or key employee based in Singapore as well.

- A foreign incorporated company to be granted a COR, the general position that a company has to be a Singapore-incorporated as well as resident under the test of control and management to get a COR.

The Steps To Apply a Certificate of Residence Singapore

Before applying for a COR, you might want to know if there are restrictions on who can obtain this certificate. However, you can apply only if your company is a tax resident in Singapore. The application is for a back Years of Assessment (YA), the current YA or the next YA.

Moreover, the income of your company is remitted or going to be remitted into Singapore. Additionally, a foreign-owned company refers to a company where 50% or more of its share are foreign companies or stakeholders.

If your company is eligible to obtain a COR, you can do these steps to apply a COR through the website. For Singapore Citizen or Permanent Resident Individuals, you can submit the documents here, if you are a self-employed or Sole-Proprietors or Partners, you can submit your documents here and lastly, if you are a foreigner submit your documents here.

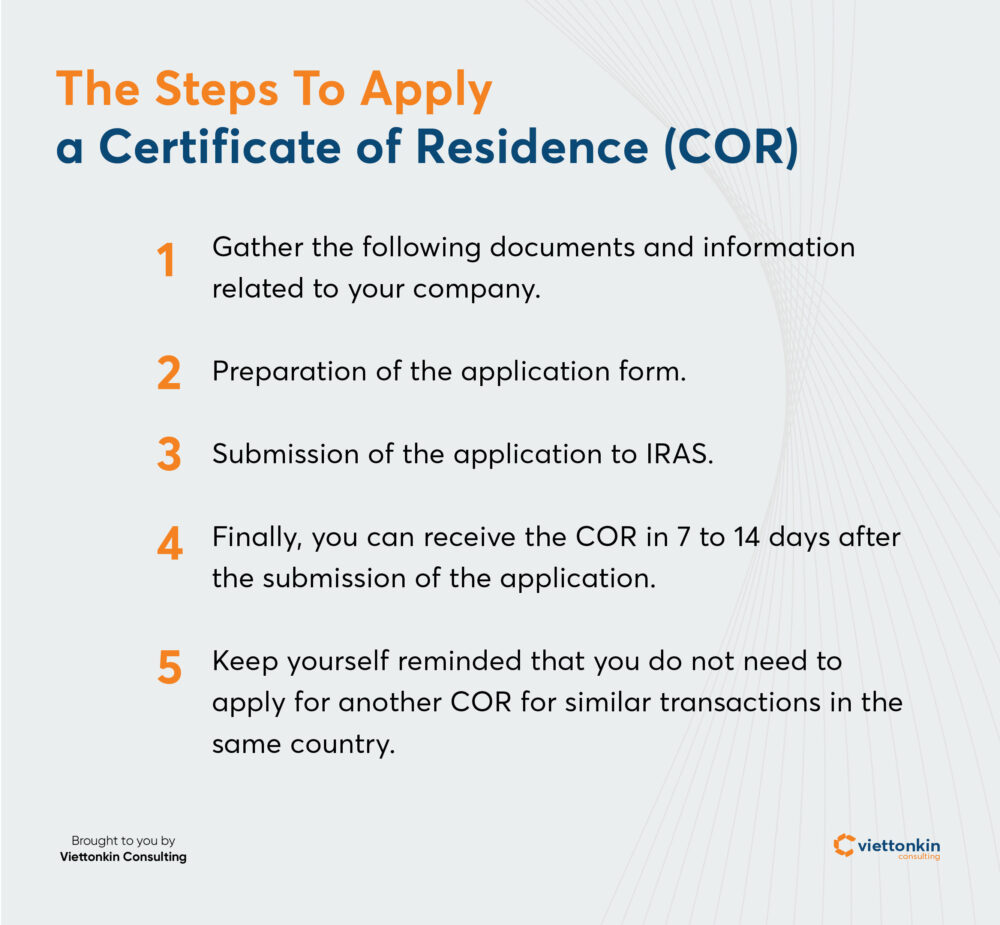

Follow the steps to apply a COR:

- Gather the following documents and information of your company:

- Company name

- Confirmation on the company is not an investment holding company with purely passive source of income

- Confirmation on the company is not a nominee company formed for the purpose of holding shares on behalf of the beneficial owners of the shares.

- Is the company receiving only foreign source income?

- Confirmation on the company is not dormant

- Name of treaty country, you can see the complete list of treaties here.

- Nature of income derived, such as Consultancy Fees, Dividend, Freight, Interest, Management Fees, Others, Professional Fees, Royalty, Service Fees and Technical Fees. You can select one of the above.

- Calendar Year in which the certificate requires.

- Preparation of the application form

- Submission of the application to IRAS. The link is mentioned above and please select one that is eligible to you.

- Finally, you can receive the COR in 7 to 14 days after the submission of application.

- Keep yourself reminded that you do not need to apply for another COR for similar transactions in the same country.

These are the information that you need to know about Certificate of Residence Singapore. Getting a COR earlier will give you the benefits that work for your company, such as tax benefits. In conclusion, if you still struggle whether to apply or not, or you simply do not understand how it works, you can contact us below. Viettonkin will be ready to assist you anytime!

English

English